I have to apologize in advance as this article will not be well formatted on this page, but try as I might, I can't seem to fix it. So please just ignore the over lapping and read this important info.

For a long time the major kingpin banks in the US were considered to be "To big to Fail", but we need to consider what happens when their failure becomes too big to save? And really..... should they be saved at all? Below is two articles - one is a pictorial that shows the truly staggering debt of these Big Banks, and the second one is about a lawsuit that has been launched against them, on behalf of home owners across the country alleging the Big 4 to be involve the largest money laundering operation in the history of the United States.

Knowing this information, I question whether I would want my money involved in any of these banks!

It's time for change everyone. Change in the way that banks are run. Change in the way that global economics and economies are run. Change in the way that governments are run. This change IS coming. Are you prepared?

This is the first article- about the lawsuit and the mega money laundering scheme being run by the big 4.

The original Press Release dated April 23 2012 can be found here:

http://www.marketwatch.com/story/home-owners-across-the-nation-sue-all-bank-servicers-and-their-offshore-havens-spire-law-officially-announces-filing-of-landmark-lawsuit-2012-04-23

PRESS RELEASE

April 23, 2012, 12:01 a.m. EDT

Home Owners Across the Nation Sue All Bank Servicers and Their Offshore Havens; Spire Law Officially Announces Filing of Landmark Lawsuit

Largest International Money Laundering Network in History Formed During Obama Administration; U.S. Banks' Theft of Home Owners' Money Laundered Through Cayman Islands, Isle of Man and Numerous Offshore-Based Affiliates

NEW YORK, NY, Apr 23, 2012 (MARKETWIRE via COMTEX) -- In a lawsuit alleged to involve the largest money laundering network in United States history, Spire Law Group, LLP -- on behalf of home owners across the Country -- has filed a mass tort action in the Supreme Court of New York, County of Kings. Home owners across the country have sued every major bank servicer and their subsidiaries -- formed in countries known as havens for money laundering such as the Cayman Islands, the Isle of Man, Luxembourg and Malaysia -- alleging that while the Obama Administration was publicly encouraging loan modifications for home owners, it was privately ratifying the formation of these shell companies in violation of the United States Patriot Act, and State and Federal law. The case further alleges that through these obscure foreign companies, Bank of America, J.P. Morgan, Wells Fargo Bank, Citibank, Citigroup, One West Bank, and numerous other federally chartered banks stole hundreds of millions of dollars of home owners' money during the last decade and then laundered it through offshore companies. The complaint, Index No. 500827, was filed by Spire Law Group, LLP, and several of the Firm's affiliates and partners across the United States.

Far from being ambiguous, this is a complaint that "names names." Indeed, the lawsuit identifies specific companies and the offshore countries used in this enormous money laundering scheme. Federally Chartered Banks' theft of money and their utilization of offshore tax haven subsidiaries represent potential FDIC violations, violations of New York law, and countless other legal wrongdoings under state and federal law.

"The laundering of trillions of dollars of U.S. taxpayer money -- and the wrongful taking of the homes of those taxpayers -- was known by the Administration and expressly supported by it. Evidence uncovered by the plaintiffs revealed that the Administration ignored its own agencies' reports -- and reports from the Department of Homeland Security -- about this situation, dating as far back as 2010. Worse, the Administration purported to endorse a 'national bank settlement' without disclosing or having any public discourse whatsoever about the thousands of foreign tax havens now wholly owned by our nation's banks. Fortunately, no home owner is bound to enter into this fraudulent bank settlement," stated Eric J. Wittenberg of Columbus, Ohio -- a noted trial lawyer, author and student of US history -- on behalf of plaintiffs in the case.

The suing home owners reveal how deeply they were defrauded by bank and governmental corruption -- and are suing for conversion, larceny, fraud, and for violations of other provisions of New York state law committed by these financial institutions and their offshore counterparts.

This lawsuit explains why loans were, in general, rarely modified after 2009. It explains why the entire bank crisis worsened, crippling the economy of the United States and stripping countless home owners of their piece of the American dream. It is indeed a fact that the Administration has spent far more money stopping bank investigations, than they have investigating them. When the Administration's agencies (like the FDIC) blew the whistle, their reports were ignored.

The case is styled Abeel v. Bank of America, etc., et al. -- and includes such entities as ML Banderia Cayman BRL Inc., ML Whitby Luxembourg S.A.R.L. and J.P Morgan Asset Management Luxembourg S.A. -- as well as hundreds of other obscure offshore entities somehow "owned" by federally chartered banks and formed "under the nose" of the Administration and the FDIC.

Commenting further on the case, Mr. Wittenberg stated: "As if it is not bad enough that banks collect money and do not credit it to homeowners' accounts, and as if it is not bad enough that those banks then foreclose when they know they do not have a legally enforceable interest in the realty, we now learn that they have been operating under unbridled free reign given by the Administration and some states' Attorneys General in formulating this international money laundering network. Now that the light of day has been shined on it, I believe we can all rest assured that the beginning of the end of the bank crisis has arrived."

All United States home owners may have the right to bring a lawsuit of this kind if they paid money to a national bank servicer during the years 2003 through 2009.

One lawyer impacted by the corruption -- Mitchell J. Stein, who formerly represented the FDIC, the RTC and the FSLIC during the Savings and Loan scandal of the 1990s, and who predicted all of the foregoing in open court two years ago -- commented: "Two years ago, I remarked in open court to a Los Angeles Superior Court Judge, as well as to legislators including Senator Dianne Feinstein's office during a multitude of in-person meetings, that the ongoing violations of the Patriot Act by these financial institutions was outrageous and a breach of the public trust of unprecedented proportions," said Stein.

"The size and scope of this misconduct -- stretching to far-away islands never before having standing as approved United States Bank affiliates -- is remarkable and emblematic of what we have seen," he continued. "The bank crisis represents the height of corruption and brazen behavior where our historically trusted financial institutions have no qualms about breaking the law, because they have the Administration behind them. Banks do well enough when they operate lawfully without needing to be permitted to operate as criminal enterprises that steal money from United States citizens."

Additional plaintiffs' counsel Nicholas M. Moccia commented: "Having been in the trenches of the bank crisis for years, I always knew that the misconduct was being conducted by a network. When I started litigating against banks, however, I could have never imagined that it would be this extensive. I look forward to taking discovery of these thousands of obscure foreign entities and to obtaining for homeowners their constitutionally entitled injuries for this international ring of theft and deception."

Comments were requested from the Attorney Generals' offices in NY, CA, NV, and MA and the White House, but no comment was provided.

About Spire Law Group

Spire Law Group, LLP is a national law firm whose motto is "the public should be protected -- at all costs -- from corruption in whatever form it presents itself." The Firm is comprised of lawyers nationally with more than 250-years of experience in a span of matters ranging from representing large corporations and wealthy individuals, to also representing the masses. The Firm is at the front lines litigating against government officials, banks, defunct loan pools, and now the very offshore entities where the corruption was enabled and perpetrated.

Contact:

James N. Fiedler, Esq.

Managing Partner

Spire Law Group, LLP

877-475-2448

Email Contact

SOURCE: Spire Law Group, LLP

http://www2.marketwire.com/mw/emailprcntct?id=3402287510A010DA

http://demonocracy.info/infographics/usa/derivatives/bank_exposure.html

| ||

| LONG STORY: A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. Ex- A derivative buys you the option (but not obligation) to buy oil in 6 months for today's price/any agreed price, hoping that oil will cost more in future. (I'll bet you it'll cost more in 6 months). Derivative can also be used as insurance, betting that a loan will or won't default before a given date. So its a big betting system, like a Casino, but instead of betting on cards and roulette, you bet on future values and performance of practically anything that holds value. The system is not regulated what-so-ever, and you can buy a derivative on an existing derivative. Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk. Deriv. market has blown a galactic bubble, just like the real estate bubble or stock market bubble (that's going on right now). Since there is literally no economist in the world that knows exactly how the derivative money flows or how the system works, while derivatives are traded in microseconds by computers, we really don't know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times, that will be catastrophic for the world financial system since the 9 largest banks shown below hold a total of $228.72 trillion in Derivatives - Approximately 3 times the entire world economy. No government in world has money for this bailout. Lets take a look at what banks have the biggest Derivative Exposures and what scandals they've been lately involved in. Derivative Data Source: ZeroHedge. |

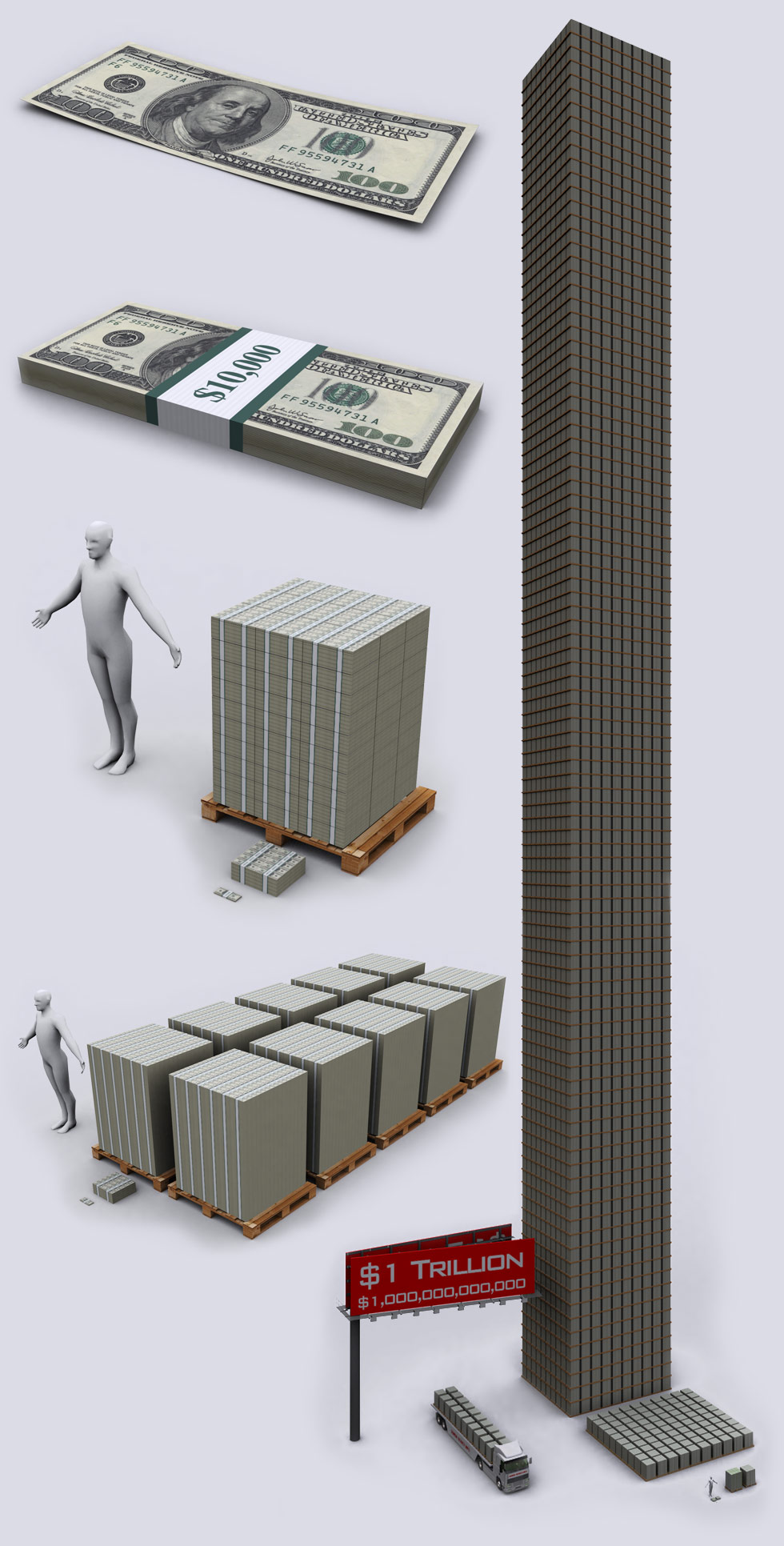

| One Hundred Dollars |

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

| Ten Thousand Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| 100 Million Dollars |

| $100,000,000 - Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet. $1 Million is the cash square on the floor. |

| 1 Billion Dollars |

| $1,000,000,000 - This is how a billion dollars looks like. 10 pallets of $100 bills. |

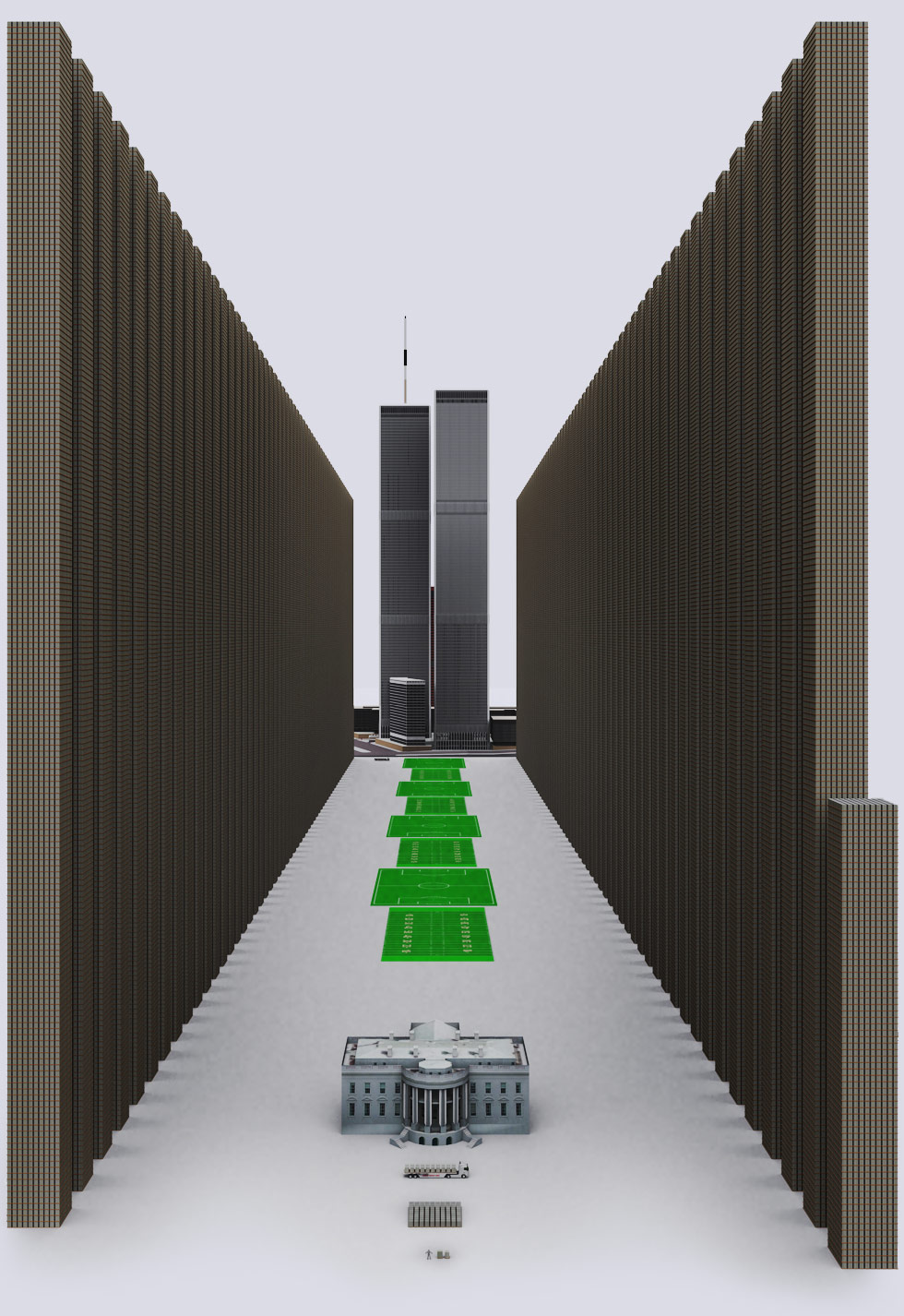

| 1 Trillion Dollars |

| $1,000,000,000,000 - When they throw around the word "Trillion" like it is nothing, this is the reality of $1 trillion dollars. The square of pallets to the right is $10 billion dollars. 100x that and you have the tower of $1 trillion that is 465 feet tall (142 meters). |

|

| Bank of New York Mellon |

| BNY has a derivative exposure of $1.375 Trillion dollars. Considered a too big to fail (TBTF) bank. It is currently facing (among others) lawsuits fraud and contract breach suits by a Los Angeles pension fund and New York pension funds, where BNY Mellon allegedly overcharged the funds on many millions of dollars and concealed it. |

| State Street Financial |

| State Street has a derivative exposure of $1.390 Trillion dollars. Too big to fail (TBTF) bank. It has been charged by California Attorney General (among other) lawsuits for massive fraud on California's CalPERS and CalSTRS pension funds - similar to BNY (above). |

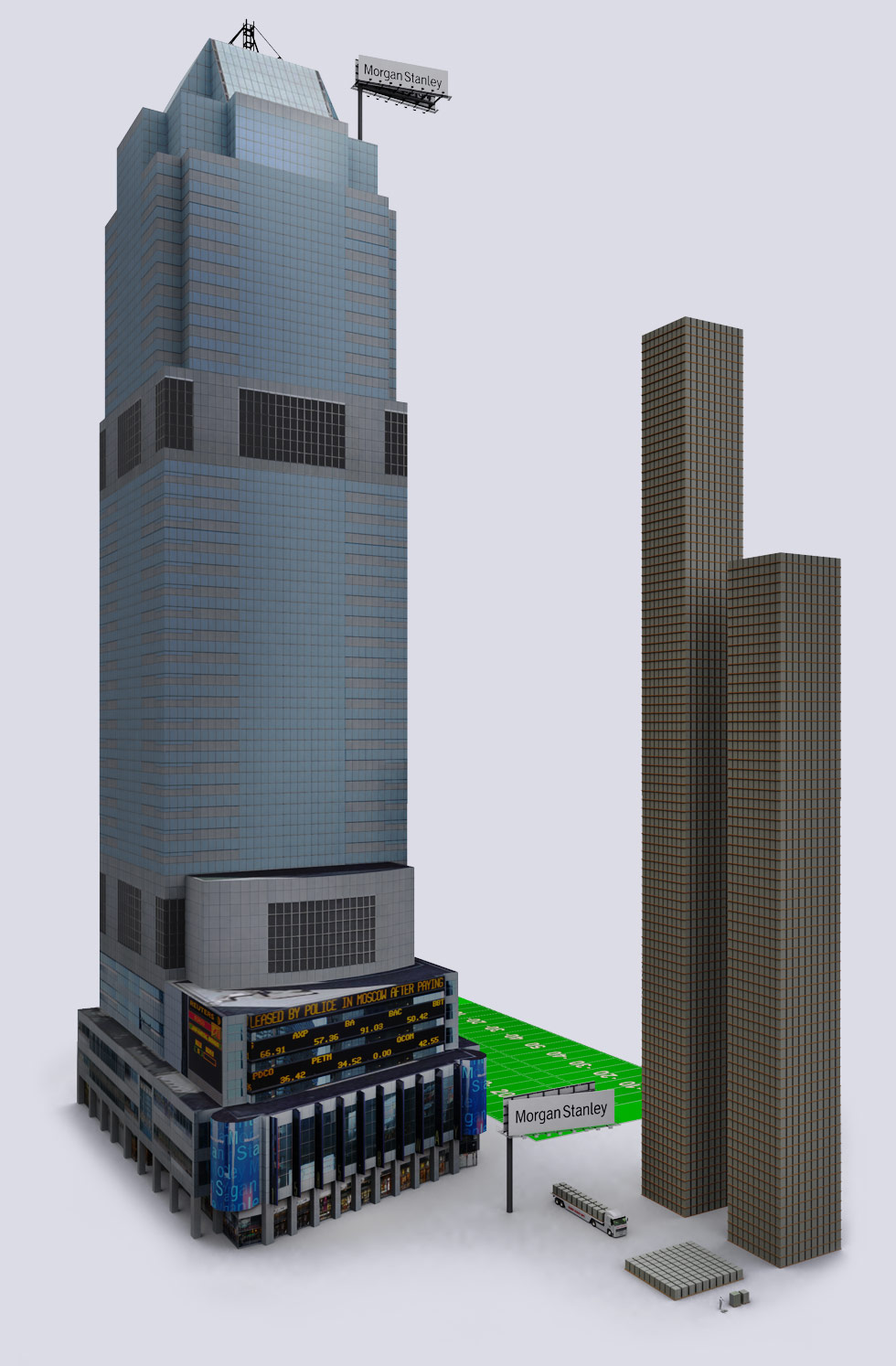

| Morgan Stanley |

| Morgan Stanley has a derivative exposure of $1.722 Trilion dollars. Its a too big to fail (TBTF) bank. It recently settled a lawsuit for over-paying its employees while accepting the tax payer funded bailout. Vice Chairman of Morgan Stanley had a license plate that said "2BG2FAIL" on his Porsche Cayenne Turbo. All this while $250 million of bailout money ended up in the hands of Waterfall TALF Opportunity, run by the Morgan Stanley's owners' wives-- Marry a banker for a $250M tax-payer cash injection. The bank also got a SECRET $2.041 Trillion bailout from the Federal Reserve during the crisis, beyond the tax payer bailout. |

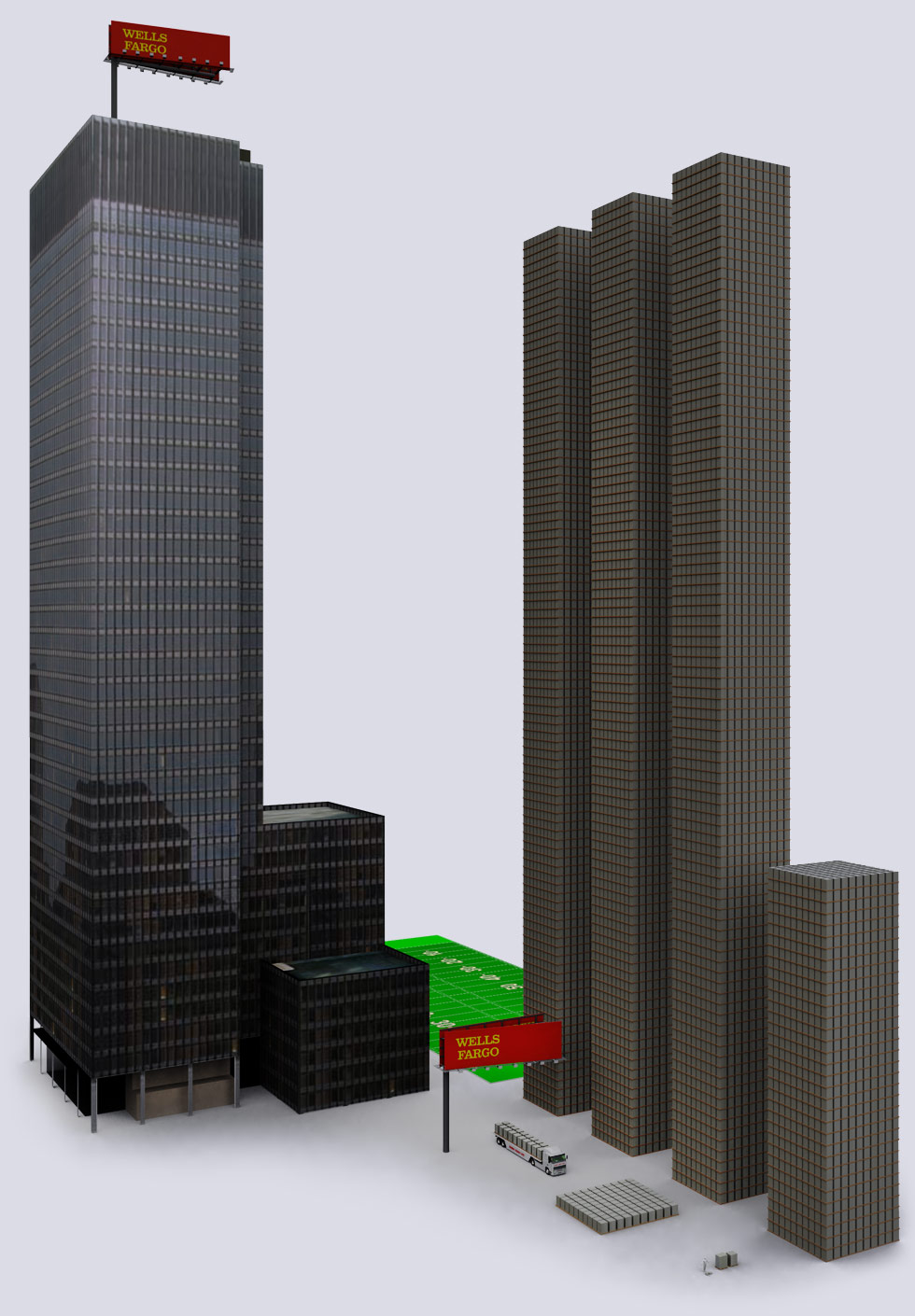

| Wells Fargo |

| Wells Fargo has a derivative exposure of $3.332 Trillion dollars. Its a too big to fail (TBTF) bank. WF has been charged for its role in allegedly pursuing illegal foreclosures and deceptive loan servicing. Wells Fargo was just slapped with a $85 million fine by Federal Reserve for putting good credit borrowers into bad-credit rating (high rate) loans. In March 2010, Wachovia (owned by Wells Fargo) paid $110 million fine for allowing transactions connected to drug smuggling and a $50 million fine for failing to monitor cash used to ship 22 tons of cocaine. It also failed to monitor $378.4 billion (that's $378400 millions dollars) worth of transactions to Mexican "casas de cambio" (think WesternUnion, anonymous cash transfer) usually linked to drug cartels. Beyond that, WF lets its' VIP employees live in foreclosed mansions. WF knows how to cash your legit check, then claim "fraud" and close your account. WF also re-orders your transactions to create more overdraft fees. Wells Fargo's Wachovia also got aSECRET $159 billion bailout from the Federal Reserve. Wells Fargo paid NO taxes in 2008-2010 and had a tax rate of NEGATIVE 1.4% while making $49 billion in profit during the same time. |

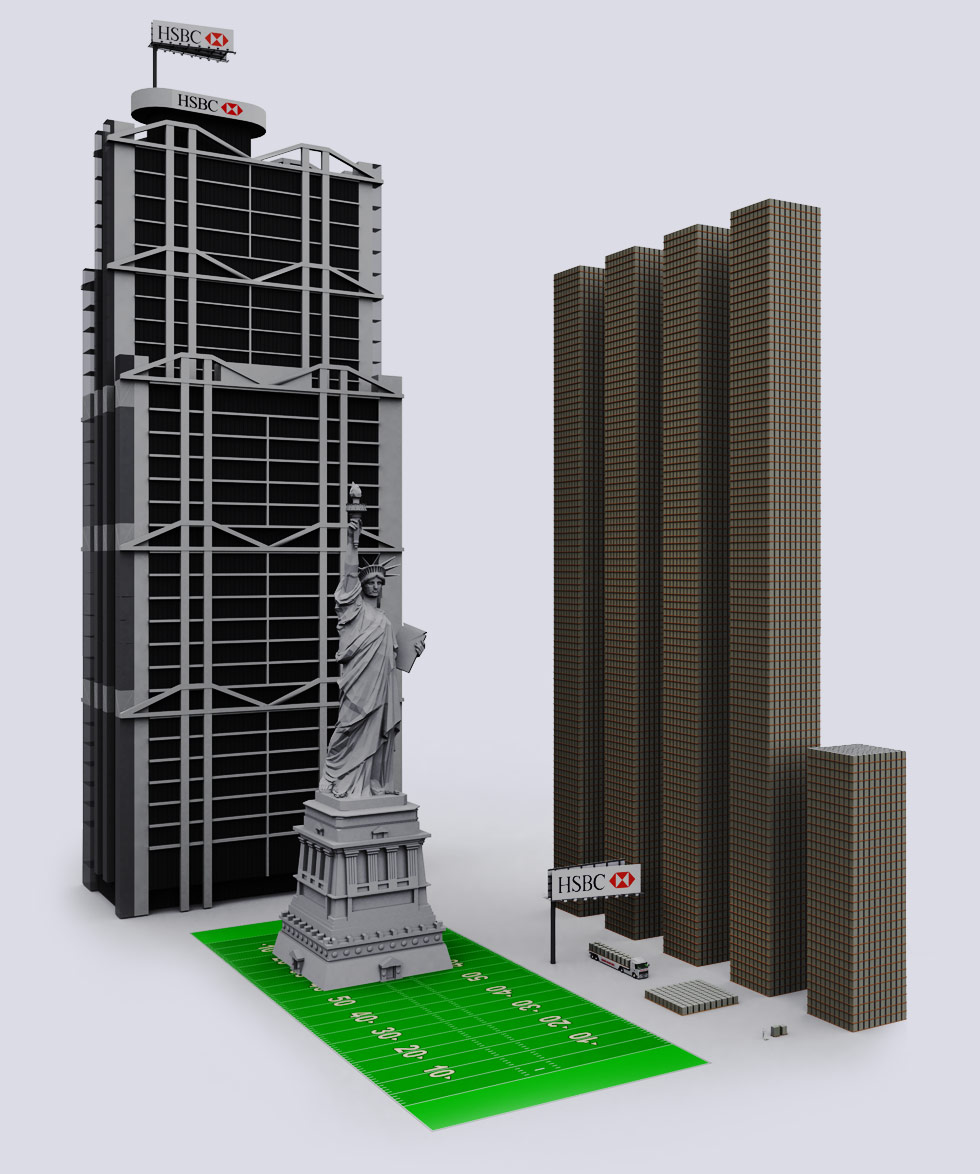

| HSBC |

| HSBC has a derivative exposure of $4.321 Trilion dollars. HSBC is a Hong Kong based bank and its original name is The Hongkong and Shanghai Banking Corporation Limited. You will find HSBC working a lot with JP Morgan Chase. Both HSBC and JP Morgan Chase have strong interest in gold & precious metals. HSBC and JP Morgan Chase are often involved together in financial scandals. Lately HSBC has been sued for allegedly funneling more than $8.9 billion to the largest ponzi-scheme in history - Bernie Maddof's investment business. HSBC (along w/ JP Morgan Chase) has been sued for alleged conspiracy suppressing the price of silver and gold, partially through precious metal DERIVATIVES and making billions of dollars on it. State of Hawaii is suing HSBC (and other banks) for deceptive credit card lending practices. DZ Bank in Germany is suing HSBC (and JP Morgan) for deceptive (lying) practices when selling home-loan-backed securities. HSBC is also under investigation for laundering billions of dollars. |

| Goldman Sachs |

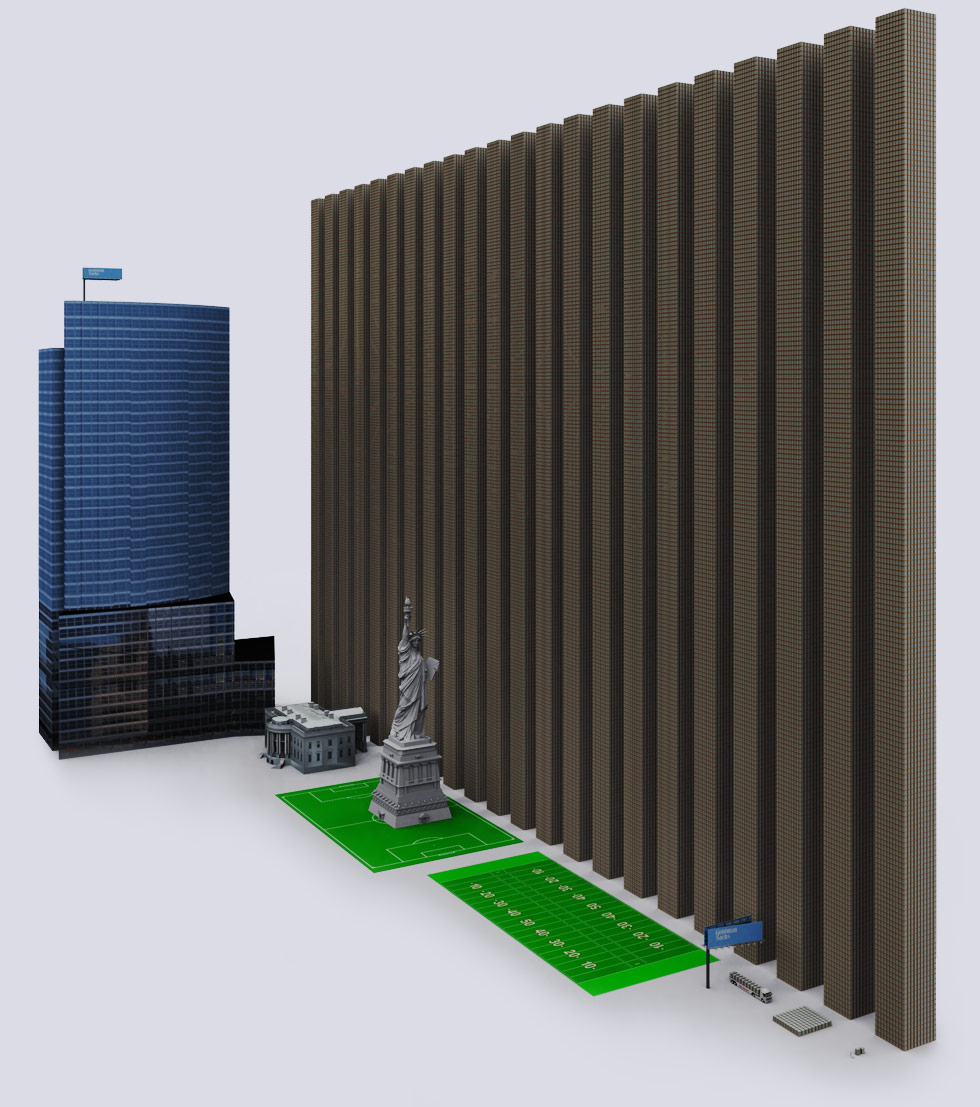

| Goldman Sachs has a derivative exposure of $44.192 Trillion dollars. The $1 Trillion pillars towers are double-stacked @ 930 feet (248 m). The White House is standing next to the Statue of Liberty. Goldman Sachs has advantage over other banks because it has awesome connections in US Government. A lot of former Goldman employees hold high-level US Government positions (chart). Mitt Romney's top donor is Goldman Sachs, and one of Obama's best donors. Ex-CEO of Goldman Sachs, Hank Paulson became the Secretary of Treasury under Bush and during the 2008 financial crisis authored the TARP bill demanding $700 billion bail-out. In UK, Goldman Sachs escaped £10 million bill on a failed tax avoidance scheme with help of good connections. The bank is the largest player in the food commodities market, earned $955m from food speculation in 2009" - That's your $$$. Goldman Sachs employees are arming themselves with guns in case there is a populist uprising against the bank. Goldman Sachs calls their investors "muppets". and use clients to make money for themselves, disregarding the clients. The bank was fined $22 million for sharing valuable nonpublic information with top clients (Think insider trading with best clients). Goldman Sachs was part-owner America's leading website for prostitution ads until the ownership stake was exposed. Goldman Sachs helped Greece conceal its debt with secret loans, while simultaneously taking advantage of Greece. Goldman Sachs got a $814 billion SECRET bailout from the Federal Reserve during the 2008 crisis. Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and "benefits", while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach's employee. |

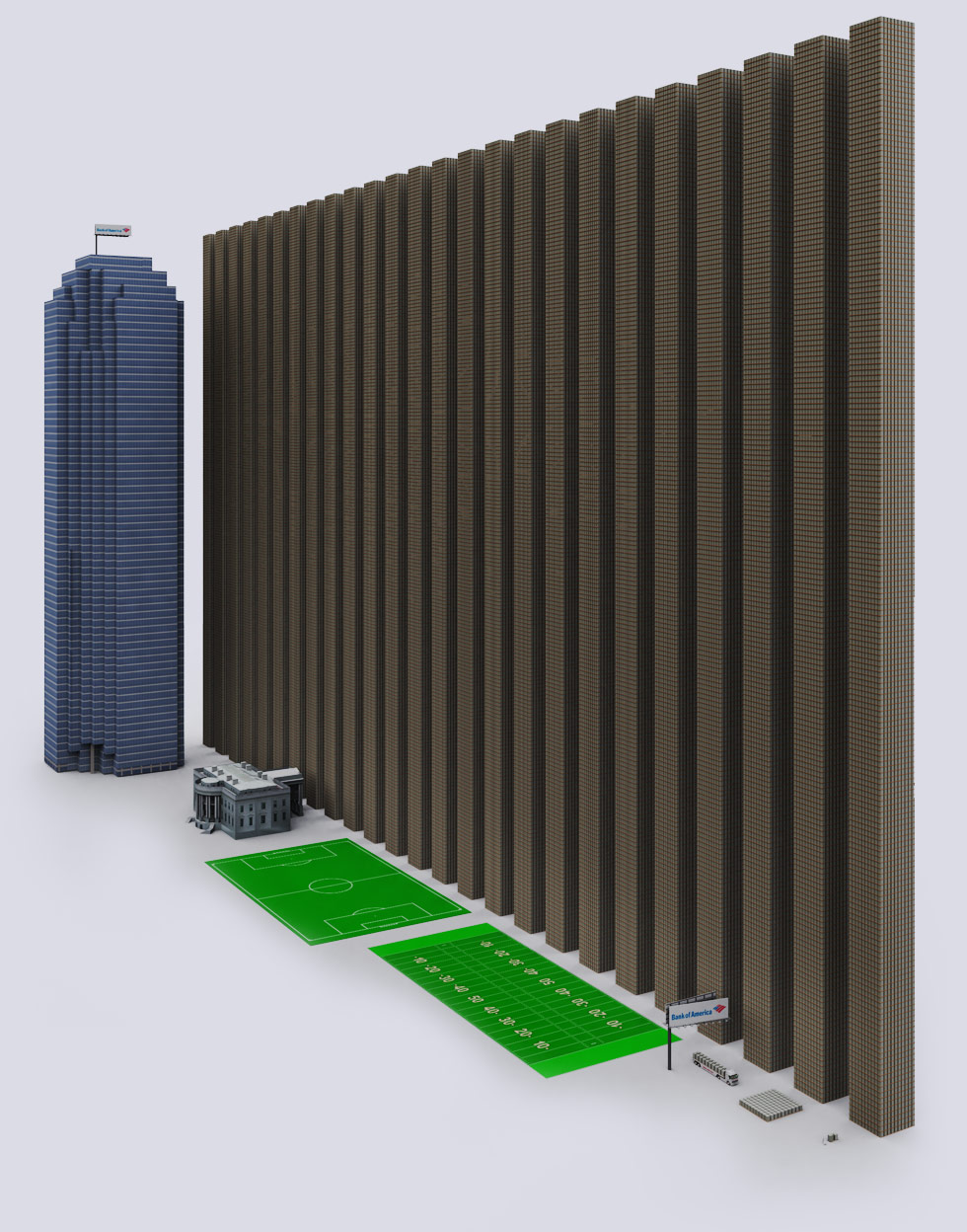

| Bank of America |

| Bank of America has a derivative exposure of $50.135 Trillion dollars. BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives to accounts insured by the federal government @ total of $53.7 trillion as of 06/2011. During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion. Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash. Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops BofA recruited 3 cyber attack firms to attack WikiLeaks. but the Anonymous hacker group hacked the security firms first. BofA was sued for $31 billion in home-loan losses in 2011, the bank is involved in many lawsuits, too many to document. BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve. |

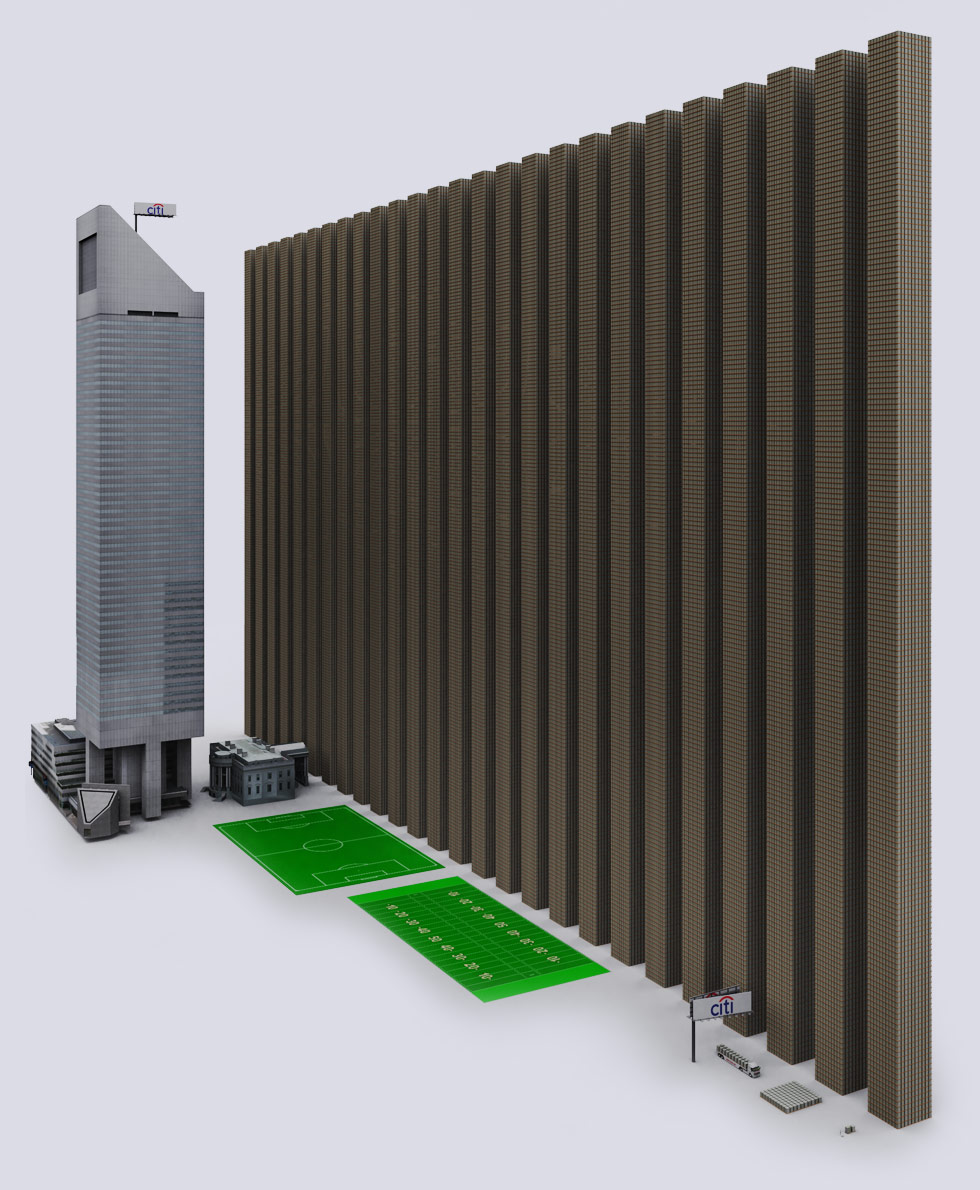

| Citibank |

| Citibank has a derivative exposure of $52.102 Trillion dollars. The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m). Citibank customers have been arrested for trying to close their accounts, while in in Indonesia a man was interrogated to death in Citibank's special "questioning room". In 2011 Citibankpaid a fine of $285 million for selling home-loan backed bonds to investors, while betting they would lose value (think derivatives/insurance). The man in charge of the unit at Citibank became Obama's Chief of Staff. 2 weeks before getting hired by Obama he got $900,000 from Citibank for great performance. This was after Citigroup took out $45 billion in bailout money. Citibank knowingly passed over bad loans to the Federal Housing Administration to insure. Citigroup also received a SECRET $2.513 trillion dollar bailout from the Federal Reserve. |

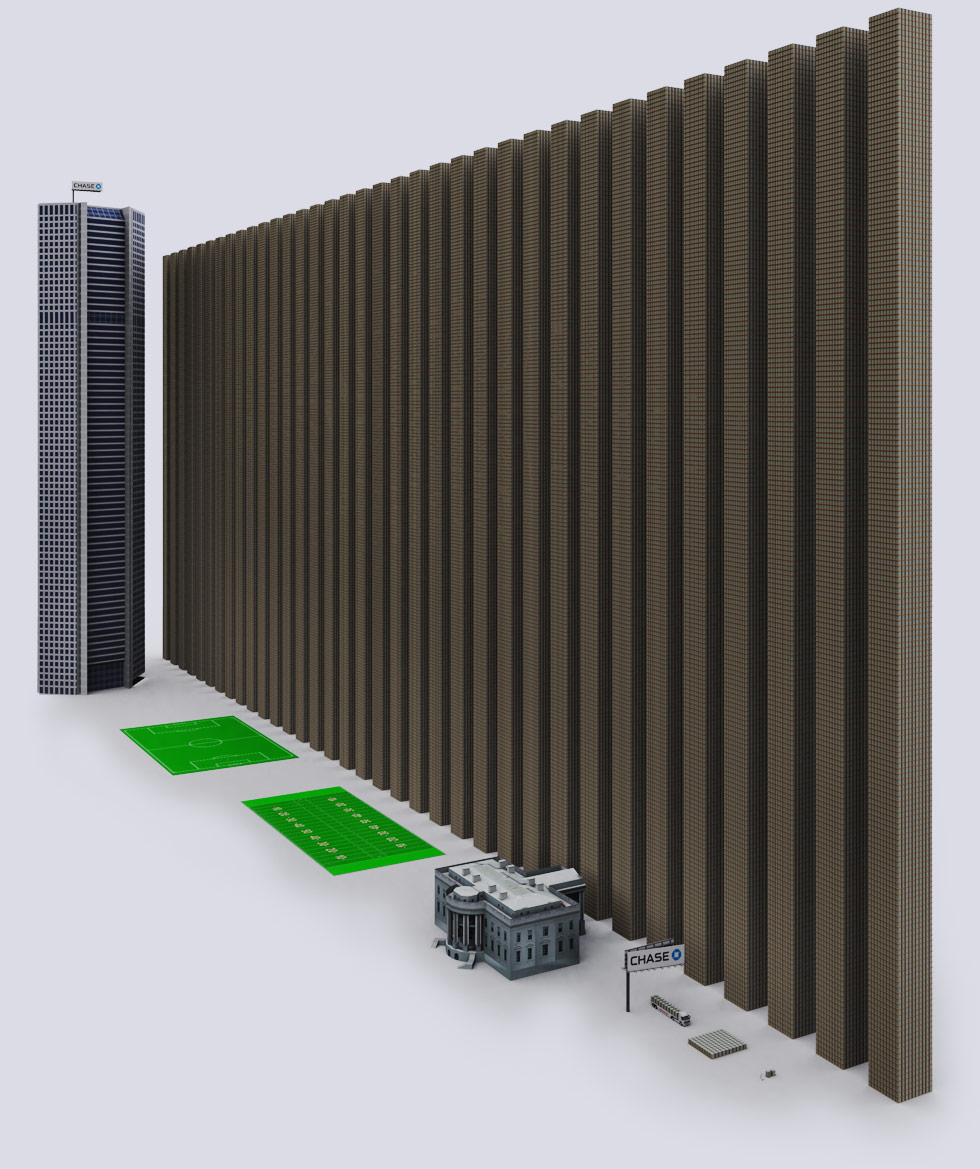

| JP Morgan Chase |

| JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars. $70 Trillion is roughly the size of the entire world's economy. The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m). JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases. JP Morgan is also guilty of manipulating the silver market to make billions. In 2010 JP Morganhad 3 perfect trading quarters and only lost money on 8 days. Lawsuits on home foreclosures have been filed against JP Morgan. Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport. JP Morgan was among the banks involved in theseizure of $620 million in assets for alleged fraud linked to derivatives. JP Morgan got $25 billiontaxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition. The bank is also the largest owner of BP - the oil spill company. During the oil spill the bank said that the oil spill is good for the economy. JP Morgan Chase also received a SECRET $391 billion dollar bailout from the Federal Reserve. |

| 9 Biggest Banks' Derivative Exposure - $228.72 Trillion |

| Note the little man standing in front of white house. The little worm next to lastfootball field is a truck with $2 billion dollars. There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse. If you don't want to bank with these banks, but want to have access to free ATM's anywhere-- most Credit Unions in USA are in the CO-OP ATM network, where all ATM's are free to any COOP CU member and most support depositing checks. The Credit Unions are like banks, but invest all their profits to give members lower rates and better service. They don't have shareholders to worry about or have derivatives to purchase and sell. Keep an eye out in the news for "derivative crisis", as the crisis is inevitable with current falling value of most real assets. Derivative Data Source: ZeroHedge |

No comments:

Post a Comment

Note: only a member of this blog may post a comment.